CCI Indicator: Applying the Commodity Channel Index for Digital Options Trading

The CCI or Commodity Channel Index is not among the most popular technical indicators. It is undervalued by many traders. However, its advantages for trading are evident. It measures deviations from average values, which can be used by traders to identify both trends and overbought and oversold conditions. By reading this article, you will learn more about CCI and how to apply it to digital options and CFDs.

Try this indicator in live trading! Join Binolla and use various strategies with the Commodity Channel Index!

Contents

- 1 The CCI Indicator Basics

- 2 How the CCI Indicator Works

- 3 CCI Formula

- 4 Key CCI Levels and Lines to Watch

- 5 Try the CCI indicator right now!

- 6 CCI Strategies: How to Trade Using This Indicator

- 7 Best Settings for the CCI

- 8 CCI Combinations with Other Indicators

- 9 Pros and Cons of using the CCI indicator

- 10 Tips for Using the CCI Indicator

- 11 Conclusion

- 12 FAQ

The CCI Indicator Basics

The CCI indicator is a momentum-based technical analysis tool that measures how far the price deviates from its average reading over a specific period. The indicator was developed by Donald Lambert and was first applied to commodities. However, later, traders tried it with different types of assets, and the indicator demonstrated great results.

Unlike many other oscillators, the indicator has no maximum and minimum values, which allows traders to see potential reversals and unusually strong quotes. Here are the main purposes of using the CCI indicator:

- Identifying overbought and oversold conditions.

- Detecting the strength of the current price movement.

- Finding possible trend reversals and continuations of the one-sided movements.

When the CCI is above zero with higher values, it suggests a strong bullish momentum. On the other hand, when the indicator is below the average, it indicates a strong bearish momentum. By grasping these deviations, traders can understand market behavior.

How the CCI Indicator Works

The indicator measures the distance between the current price and the historical average. It is not focusing only on direction. The indicator also highlights any unusual movements compared to normal price fluctuations. The Commodity Channel Indicator works according to the following concept:

- Typical price calculation. The indicator uses the typical price instead of the closing prices, which is more balanced.

- Determination of the average typical price. A moving average is used to calculate average typical prices over a set period (the indicator is used with 14 or 20 periods in most cases).

- Price deviation measurement. Now the indicator compares the current typical price with the average typical price.

CCI Formula

The Commodity Channel Index is calculated automatically, which means that you don’t need to make any calculations on your own. However, knowing the formula will allow you to better understand how it works and, thus, improve the effectiveness and performance.

CCI works with the following formula:

CCI = (TP – SMA)*0.015*Mean Deviation

Where:

- Typical price = High + Low + Close

- SMA – a simple moving average of the Typical Price (14 or 20 periods)

- Mean Deviation measures how much prices deviate from their average

- The constant (0.015) is used to normalize CCI values.

Key CCI Levels and Lines to Watch

The indicator consists of three levels: The zero line, +100, and -100. Let’s take a closer look at them.

Zero Line

The zero line is the central line of the indicator,r, and it plays a very important role in understanding which side is currently dominating the market. When CCI is above 0, bulls are dominating, while when the indicator is below the zero line, bears are taking control. Also, by using this zero line, traders can see when the market is switching momentum.

Overbought Zone

The +100 line is the overbought zone, which means that the price is significantly above the average. When the indicator reaches this zone, it indicates strong bullish momentum and can even signal an overbought condition if the CCI is above +100. Keep in mind that in trending markets, the indicator may remain in this area for extended periods.

Oversold Zone

When the price goes close to the -100 line, it means that the asset is oversold. Also, such readings indicate strong bearish momentum. When the bearish trend is developing, the indicator may remain oversold for longer periods.

CCI Strategies: How to Trade Using This Indicator

Apart from showing various market conditions, the indicator can be applied in several ways to identify entry points. Here are some of the most popular strategies that you can use when setting this indicator.

Overbought and Oversold Strategies

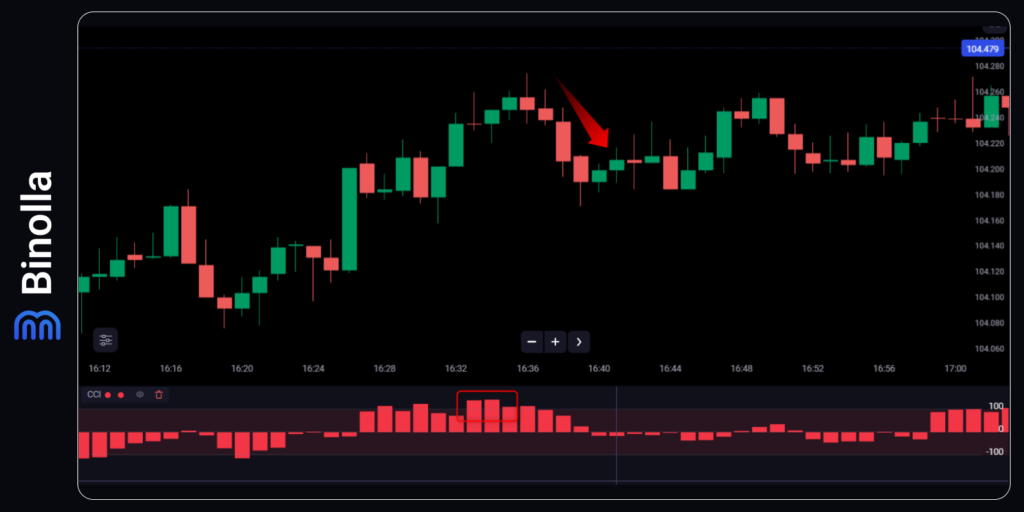

One of the most basic applications of the indicator is to find entry points when the CCI is in the overbought or oversold conditions.

When the histogram or the line of the indicator (both can be found depending on the version of the tool) goes below -100 and then moves back above -100, this is a great signal to buy a Higher contract. Traders should press the button when the histogram closes above -100. Additionally, if you use candelstick patterns, you can use the indicator to confirm entries. In this case, you buy with the reversal pattern candlestick closes and then simply wait for expiration.

This is another version of this strategy, but this time, the indicator moves above +100, and then it goes below this level. With this strategy, you can buy a Lower contract right at the moment when the histogram builds below +100. You can also use reversal candlestick patterns like shooting star or bearish engulfing to spot reversals and buy Lower contracts using them, and confirm a reversal with the CCI indicator.

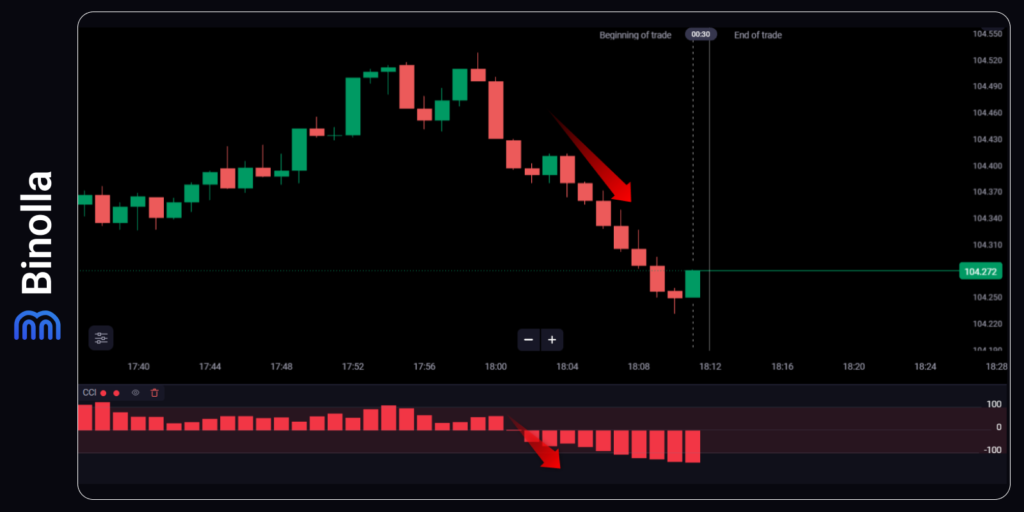

Trend-Following Strategies

Traders can use the indicator to seize longer trends. When it comes to digital options, you get a clear and simple signal. When the indicator goes below 0, it confirms that the bearish pressure is strong. Once a histogram closes below this middle line, then a trader can buy a Lower contract. As you can see, later, the indicator moves towards -100 and even breaks this line.

The same is when the line goes above the zero level. The uptrend is confirmed, and a trader can buy a Higher contract. Remember that those two strategies are less popular among digital options traders, as even if their signals are clear, the price may reverse for a while until the one-sided movement resumes.

Breakout Strategies

This is quite an easy strategy, but you should first define the closest resistance level (or support if the price moves downwards). The idea is to buy a Higher contract when the price breaks above the resistance level with CCI moving above the 0 level. Traders can buy right at the moment of the breakout if the histogram starts building above zero.

Best Settings for the CCI

Traders often “play” with settings to improve the performance of the indicator. Here are some recommendations that may help you better set up the tool according to your trading style. First, it is worth mentioning that the indicator comes with a period of 14 or 20. These settings are widely used and very popular among traders as they offer responsiveness and reliability, which makes the indicator suitable for all categories of traders.

Short-Term Trading Settings

Those who prefer scalping strategies and intraday trading systems can decrease the period to 5-10. This will allow you to get faster signals and receive more signals. However, even if you have more entry points, there are risks of false signals. Traders can use these periods on lower timeframes, but they should also remember to confirm entry points with price action or use other filters.

Long-Term Trading

If you go beyond digital options and trade long-term CFDs, then you can increase the period to 30 or even 50. This will smooth the CCI movement and provide traders with fewer but stronger entry points. One of the advantages of using these settings is that market noise will be reduced.

CCI Combinations with Other Indicators

CCI is an independent indicator that provides several strategies itself. However, you can augment it with additional indicators to make it even more efficient. Find out more about some of the most popular combinations below.

CCI + Moving Averages

If you use this combination, which includes the CCI indicator and a simple moving average of 50, then you can get a clear picture of a longer-term trend and trade along it when using CCI signals. This combination works better for CFDs as this approach is designed to catch extended price movements.

CCI + RSI

Combining two oscillators may seem unnecessary, but these indicators can be complementary in various trading situations. CCI reacts faster to any price changes, while RSI is used to confirm overbought and oversold conditions.

Pros and Cons of using the CCI indicator

The Commodity Channel Index has its advantages and disadvantages. Knowing them will allow you to better understand whether to use this tool in your strategies or not.

Advantages of the CCI

The pros of using the CCI indicator include:

- The indicator can be applied across various assets and markets. While CCI was primarily designed for commodities, this indicator has proven its usefulness for FX currencies, cryptos, stocks, and other assets.

- Earlier signals. The indicator provides quick signals that appear even earlier than those from RSI.

- CCI can be used in various market ccontexts Unlike many other indicators, CCI can be applied to both ranging and trending markets.

- Clear visual interpretation. The indicator gives clear signals, which makes it the best tool for all types of traders.

Disadvantages of the Indicator

While there are many advantages, some limitations also exist. They include:

- False signals. Even if CCI is considered a reliable indicator, false signals may occur. Therefore, you should be able to filter them and choose only those entries that will develop into profits.

- Overbought does not mean reversal. Even if the market is overbought or oversold, you can’t be sure that a reversal will occur without additional filters.

- The indicator requires confirmation. CCI can be used alone, but it is better to find a good combination with other indicators or technical analysis tools.

- CCI is sensitive to settings. Shorter periods will increase market noise, while longer periods will delay entries and provide fewer signals.

Tips for Using the CCI Indicator

Now that you know more about the CCI itself and have grasped some strategies, it is time to delve into some useful tips to improve the performance of your strategy. Check some of our recommendations to make your trading with the CCI even more efficient:

- Check the market context. When using the CCI, it is better to know whether the price is trending or moving sideways before applying any strategy. While overbought and oversold signals work better in range markets, breakout signals can be used when the market is trending.

- Always confirm signals. Use other indicators to confirm signals that come from the CCI. For instance, you can buy at oversold if a reversal pattern occurs there.

- Know how to adjust the settings. It is not necessary to adjust the indicator all the time. You should clearly understand the purpose of such adjustments. For instance, if you are looking for faster signals on smaller timeframes, then you should lower the period.

- Manage your risks properly. The indicator does not provide any clues about where to place stop losses for CFD traders (digital options traders do not need them at all). Therefore, you should be able to protect yourself from false signals with stop losses that are calculated based on your risk-to-reward ratio.

Conclusion

The CCI is often shadowed by more popular oscillators like RSI or Stochastic. However, if you grasp how it works, you will unlock its full potential in identifying overbought/oversold conditions as well as pinpointing market trends. The indicator can be applied to various types of assets, including currencies, cryptos, stocks, commodities, and others. One of the best parts is that you can adjust it for various trading styles, whether you want quick entries or look for long-term opportunities.

FAQ

What is the difference between CCI and RSI?

The Relative Strength Index measures the speed of change of price movements, while the CCI shows how far the price deviates from its average typical prices.

Can I apply CCI for day trading?

Yes, sure! The indicator can be applied to day trading, but you should switch to hourly timeframes. Also, you should play with the settings to adjust them and show better performance.

Is CCI better for sideways or trending markets?

The indicator works in both market contexts, which makes it a universal tool for all possible market cases.

What are the best settings for CCI?

There are no golden settings for the indicator. You should adjust it according to your trading style and what you expect from it. By lowering the period, you will have more signals, but the number of fake ones will increase. By increasing the period, you will limit the number of signals, but market noise will be reduced as well.

Can I use CCI alone?

Yes, CCI is an independent technical indicator. However, traders often use it in combination with other indicators to improve their performance.