Buy and Sell Limit Orders in Forex: How to Use Them to Improve Your Trading Performance

Limit orders are often used by professional traders to pick the moments when the most favorable price is. While market orders are the most popular type of deals, sometimes you may need to wait for a better price to open the position. By reading this article, you will learn more about buy limit, sell limit, buy stop, sell stop, and other limit orders that are available on the MetaTrader 5 trading platform. Moreover, we will provide you with some examples and strategies that you can apply to automate your trading sessions.

Try all types of orders with a reliable trading platform. Join Binolla now and pave your way to success there!

Contents

Key Takeaways

- Traders can choose between market and pending orders;

- There are 6 types of pending orders on the MetaTrader 5 platform;

- Market participants can set orders to catch a better price or buy and sell at breakouts;

- Buy stop limit and sell stop limit orders are more complex variations of buy/sell stop and buy/sell limit orders;

- Both pending and market orders have their advantages and drawbacks. You should understand them before choosing a particular type.

Limit Orders Basics

Limit orders are special orders allowing traders to buy or sell at a specific price, which is below or above the current price. With this feature, you can create even more strategies and start trading even if you have no access to the platform at the moment. To understand the nature of such orders, let’s look at an example.

Imagine that the current EUR/USD price is 1.0492. You want to sell the currency pair at 1.0500 to increase your eventual gains for 8 pips. In this particular situation, you can place a sell limit order and set 1.0500 as the price at which the order will be completed.

Let’s see the opposite example. EUR/USD fluctuates at 1.0492. However, you expect it to surge and you want to buy the currency pair at 1.0480 before it moves higher. Therefore, you can place a buy limit order at 1.0480 and if the price reaches this level, your buy limit order will trigger.

Once the price reaches the preset level, the order triggers and transforms into a standard sell position. Therefore, using this order allowed you to improve your position and enter at a better price.

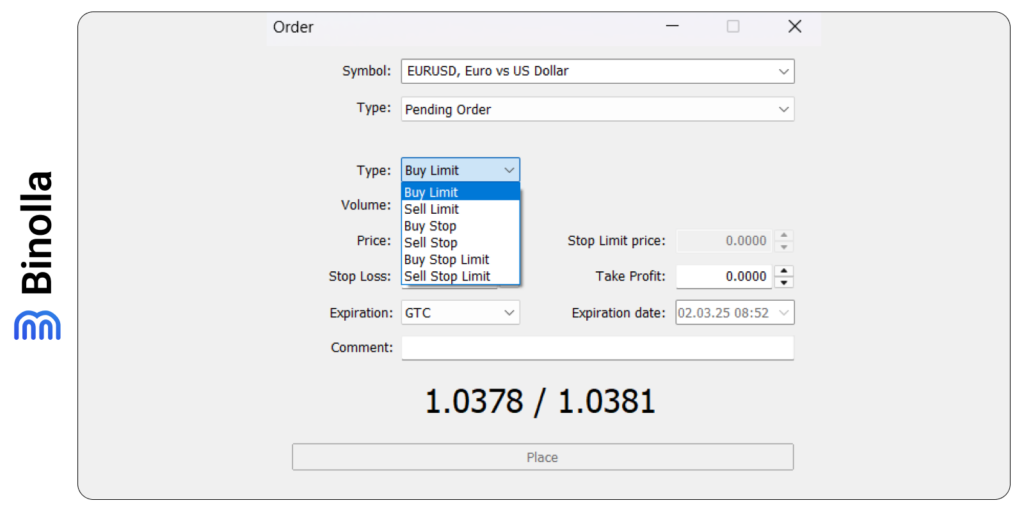

With the MetaTrader 5 platform, you can choose from 6 types of pending orders:

- Buy Stop;

- Buy Limit;

- Sell Stop;

- Sell Limit;

- Buy Stop Limit;

- Sell Stop Limit.

Let’s have a closer look at each one.

Buy Stop

Sometimes professional traders use this type of Forex order to buy at a specific price, which is above the current price. You may say that the order is not useful as the main goal of a trader is to buy at a lower price to make more gains. However, applying a buy stop may be very beneficial in some situations.

The main reason why traders sometimes use this type of limit order is that they want to enter the market at a breakout. As you can see in the example above, the price has been testing the resistance level for some time. You can sit and wait until the breakout takes place or set a buy stop order in advance.

In this particular example, the resistance level is set at 1.0453. Therefore, you can place a buy stop order somewhere above this mark. Keep in mind that the resistance line is not an exact level. There is rather an area and you need to be careful when placing buy stop orders in order to avoid fake breakouts.

When placing buy stop orders, traders and investors have the following options:

- Volume. Here you need to choose how many lots you are going to buy when the buy stop price is reached;

- Price. This is the price level at which you want to purchase the asset;

- Stop loss. Traders can set the specific price at which the trade will be closed if the price goes in the opposite direction of their forecasts. Keep in mind that the stop loss will be activated only if the order is triggered. If the price moves below before the buy stop loss is activated, the stop loss will not work;

- Take profit. You can also fix your profits to automate your trading sessions by using this type of order. Once the price reaches the take profit order, the position will be closed automatically and the profit will be credited to your balance;

- Expiration. By setting this feature, you can set a specific date for the buy stop order expiration. If the buy stop order does not trigger before this specific date and time, it will be automatically eliminated. Keep in mind that you can also remove the buy stop order manually.

Sell Stop

The sell stop order is designed to allow traders to sell at a specific price below the current level. Similar to buy stop, this order can be used in breakout strategies when you expect the price to break below the support level and move lower.

The reason to use a sell stop order in trading is to automate the process of opening a position. If you expect the price to break below a specific support line, then you can wait for this to occur or set a sell stop order.

When it comes to the example above, we have here the same 1.0453 level, which acts as a support level right now. Therefore, to capitalize on the future downside movement, you can place a sell stop order somewhere below this level.

Keep in mind that support is not a clear level, it is an area instead. Therefore, you should make sure that the sell stop price is set the wait to avoid fake breakouts.

When using this type of limit order, traders can also set stop losses and take profits. To cut excessive risks, you can place stop losses somewhere above the support line at a distance that you find comfortable. Keep in mind that similar to buy stop orders, stop loss will trigger only if the main sell stop order is activated.

Sell stop orders can expire similarly to buy stop ones. You can set a specific date and time when you want this order to be removed if it was not triggered. You can either remove the order manually if you think that it is not relevant anymore.

Buy Limit

The next type of pending order is known as buy limit. Traders who place it expect the price to move lower before buying a specific asset. Normally, such an order can be placed at the closest support level.

Traders who place buy limit orders expect the price to make another downside movement before going upwards. Market participants who want to automate their trading a bit can use this option.

In the example above the current price level is at 1.0225. You can buy the currency pair right away and even in this case you will profit as the price moves higher later. However, you can also place a buy limit order below the current level to make even more money. While the support area is rather wide you can select a round number like 1.0190 to place a buy limit order.

Similar to buy stop and sell stop orders, you can place stop losses and take profits there. The stop loss can be placed below the lowest point there or at a distance that you may find comfortable. Buy limit orders allow you to use an automated expiration feature. You can set a specific date and time when the order will be removed automatically if it is not triggered.

Sell Limit

This type of limit order allows you to sell at a higher price than the current one. Sell limit is frequently placed at the closest resistance level allowing market participants to enter the market at better quotes.

In this particular example, a trader can use a sell limit order if they expect the price to reach the closest resistance level. Even without drawing the line, you can clearly see that there is a previous peak and you can expect that the quotes will establish a new one before moving down. Entering at a market price will prevent you from such an opportunity.

Similar to other types of limit orders, traders can set stop losses and take profits. To protect you from higher risks, you can set a stop loss somewhere above the resistance level at which you sell an asset. Take profit can be calculated based on your risk/reward ratio. For instance, if you place a 10 pips stop loss, then you can place a 30 pips take profit and your risk/reward ratio will be approximately 1:3.

If you expect the price to reach your sell stop level in the near future, you can set an order expiration feature. If the price does not hit the level before a specific date and time, the order will be removed.

Buy Stop Limit

This is a more complex type of limit order that is used by traders to specify some conditions when the buy stop order will trigger. A trader sets a specific stop limit price, which is normally below the current one. If the quotes hit it, a buy stop limit will be active and a buy order will be triggered once the price reaches the buy stop level.

It may sound more complicated, but this type of pending order is very straightforward. If you are trading within a range, for instance, and expect the price to break the resistance level, then you may want a confirmation. Therefore, by placing the buy stop limit order, you will have a confirmation that the price will hit the support level and then break above the resistance one.

Stop losses are also available in this type of order. They can be placed somewhere below the buy stop level. However, they will trigger after and only after the buy stop is active. You can also set an expiration date and time to remove the order automatically if all the conditions of the buy stop limit order are not met within a given period.

Sell Stop Limit

Similar to buy stop limit, traders can use its variation for the downside movement. However, this time you sell a sell limit price and the price at which the sell limit order will be executed. The sell limit price is above the current price. If the quotes reach it, the sell stop will be triggered and the deal will be executed only if the price hits the sell stop, which is below the current price.

Similar to other types of limit orders, this one allows you to set stop losses, take profits, and expire. Stop losses can be set somewhere above the sell stop level and they will not be active until the whole order is executed. When it comes to expiration, you can set a specific date when the order will be canceled if not executed entirely.

Limit Orders vs. Market Orders: The Benefits and Drawbacks of Both Types

Now that you know the difference between the limit and market orders, it is time to pinpoint the advantages and disadvantages of both types.

| Pros | Cons | |

| Market orders | Trade Execution. When placing a market order, you give an order to the broker to execute your deal right away at a current price. The only thing that may happen is slippage or requotes that will not allow you to enter the market at the exact market price | Not entering the market at the best possible price. Even if the price is close to a specific level when placing a market order you can’t guarantee that the price won’t go in the opposite direction for a while before moving in the direction of your forecast. Therefore, the price at which you enter the market may not be the best one |

| Total control over your trading activities. With market orders, you know exactly when you enter a trade and you control the situation. You don’t need to wait or plan more sophisticated conditions in advance, which makes it a good strategy for beginners | Larger spreads may occur. If you enter the market at a time of higher volatility or important news reports, the spread may be larger. However, if you expect the price to stay in this area for a while and place a pending order, you may avoid larger spreads as once the situation calms down, you may benefit from tighter spreads | |

| No extra calculations. You don’t need to think or calculate levels at which the price may reverse in the future. This facilitates the whole process of placing trades | ||

| Limit Orders | You can enter the market at a better price. When buying or selling a currency pair, cryptocurrency, or stock, you don’t need to enter the market immediately. You may wait for a better price and place an order. These types of trades allow you to automate this process a bit | Fewer control over the situation. Planning for the price to reach a specific level does not guarantee that it will happen in reality. The price may not hit your buy limit level and move higher or, instead, move below the buy limit order and continue the downtrend. In the first case, you will not be in the market, while in the second case, you will lose money |

| Traders can avoid larger spreads. If choosing pending orders in some cases, you can enter the market when the volatility is lower, which allows you to avoid larger position costs | Complexity. Pending orders are more complex as compared to market execution as you have more things to plan in advance. To benefit from them, you should use them wisely and understand their features | |

| A possibility of using more sophisticated strategies. When applying such orders, you can apply more complex strategies and plan your actions in advance under various conditions |

Conclusion

Pending orders are often used by professional traders to benefit from a better price. By mastering the difference between both types of orders, you can have more flexibility in your trading sessions. Sometimes it is better to engage right away, while in some situations, you may set a specific price and automate your trading routines.

FAQ

What Is Order in Trading and How Does It Work?

An order in trading is your instruction to a broker to execute a trade at the current market or a specific price.

How Do Market Orders Work?

When you send market order instructions to the broker, the company executes it right away at the best possible available price.

How Does Limit Orders Work?

Unlike market orders, limit ones are not executed at the current market price. You set specific price conditions at which the order is triggered.

What is the Difference Between Buy Stop and Buy Limit Orders?

The buy stop order triggers with the price reaches a specific level below the current price, while the buy limit order becomes active when the price hits a level above the current market price.

Can I Use Stop Loss Orders When Placing Limit Orders?

Yes, you can. However, you should keep in mind that the stop loss will become active only if the limit order is triggered.