Bitcoin is Trading Above $100,000: Will the Godfather of All Crypto Reach Its New ATH?

BTC continues to move higher amid improved risk sentiment and fears about the future of the US economy. The first cryptocurrency ever managed to break above $100,000 again in the dying moments of spring. There are several factors that stimulate the growth of Bitcoin in spring 2025:

- Continued adoption of cryptocurrencies, including newer legislation initiatives in the United States and other major countries.

- Fears about the US economy and the situation with the US debt rating. According to the latest news, Moody’s has downgraded the US credit rating, which increase 30-year and 10-year treasury yield.

- Risk appetites that are related to the deal between China and the US, as well as negotiations between Ukraine and Russia, could pave the way to a long-term ceasefire deal.

Contents

BTC/USD: Growth Perspectives are in Focus

Bitcoin traders are focused on several aspects, but in general, market sentiment is positive at the moment, which can be seen across the whole board of cryptocurrencies. Not only is BTC showing an upside movement at the moment, but Ethereum and other cryptocurrencies and tokens have resumed the uptrend, targeting new local and historical highs.

Fears of a US economic slowdown and even stagflation prevent the US dollar from making new upside movements. Moreover, traders and investors are looking for more attractive assets to put their money in.

From the technical standpoint, BTC/USD is trading above the SMA50, which underlines buyers’ domination on the market. However, the price has tested $107,000 twice recently and rejected from there, which means that a more significant downside is possible. For buyers, Buy Stop orders can be placed above 107,000. When it comes to sellers, they can use Sell Stop orders below the SMA50. The downside is capped at 102,000. If the price breaks below this level and moves even below 100,000, then the downside can accelerate.

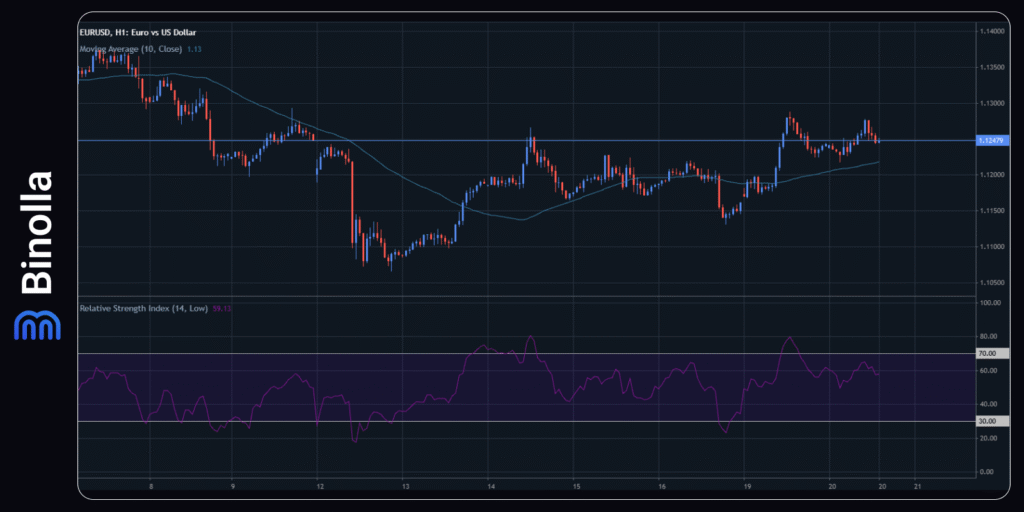

EUR/USD: Downgrade Keeps the Greenback Under Pressure

The currency pair is moving upwards this week due to the downgrade of the US credit rating. Moody’s agency downgraded it from Aaa to Aa1, which is the first move of this type by this agency towards the US since 1913. Financial markets reacted to this news by selling the US dollar. US treasuries remain attractive due to higher yields and the volume of the US debt market. Moreover, markets are looking forward to hearing some updates about the future steps by the Fed and put additional pressure on the US dollar.

From a technical analysis perspective, EUR/USD is trading above the SMA50, which indicates bullish sentiment. However, the currency pair has tested the 1.1280 area twice recently, which may lead to a broader downside if bulls fail to push the currency pair higher. On the upside, buyers can place Buy Stop orders above 1.1280-1.1300, targeting 1.1370-1.1400. On the downside, if the price breaks below 1.1230, which is a neckline, Sell Stop orders will be preferable.

WTI: Oil Is Under the Pressure

Oil price remains under pressure due to several factors. First, Russia-Ukraine talks and the following Trump-Putin phone negotiations support optimism on de-escalation and a possible ceasefire deal. Moreover, according to Trump, this deal can be reached even without US involvement. If this happens, oversupply may occur.

The next factor is the downgrade of the US sovereign debt rating. Possible stagflation may decrease demand for oil from one of the major consumers.

Crude oil is trading above the SMA50, but the dominance of bulls is under question as the quotes are testing the indicator line currently. By breaking below it, the price may continue its downside below 61.40, from where traders can place Sell Stop orders. If the upside occurs, market participants can set buy stop orders above 62.00, targeting 62.50 and 63.00.

XAU/USD: Gold is at the Crossroads

The precious metal price stays close to 3250 as traders and investors are uncertain about the situation in Europe and other regions. Moreover, the situation with the US debt rating supports gold prices as market participants are uncertain about the US debt market as well. Therefore, being a safe haven asset, gold remains popular among traders and investors.

From the technical analysis standpoint, gold is trading below 3250 and testing this level several times recently. While bulls are still in control, the precious metal is unable to break this level. Therefore, you can place Buy Stop orders somewhere below, expecting an upside momentum. If Gold breaks below the SMA50 and 3200, you can place a sell order there targeting 3170 and 3150.